Neither Hinchingbrooke nor Circle are what they seem.

The carefully created public image of Circle, the private hospital company that took over the management of Hinchingbrooke Hospital, is a triumph of PR spin – a classic exercise of smoke and mirrors.

Reference to the “success” at Hinchingbrooke has become shorthand for any right wing politician advocating privatisation as a solution to the crisis created in the NHS by coalition policies since 2010. These people, given easy platforms by journalists who uncritically rehash Circle press releases, endlessly tell us how services at Hinchingbrooke have been transformed – ignoring the fact that before it was subjected to financial distress at the hands of the old East of England Strategic Health Authority and forced into deficit it was a high performing, successful trust.

They enthusiastically quote the findings of patient satisfaction surveys – the controversial “friends and family” question – but never tell us about the most recent, disastrous, staff satisfaction survey at Hinchingbrooke, the above average absenteeism, the vacancies forcing above average spending on agency staff, the admitted failures to engage with or respond properly to staff, or even to communicate the much-vaunted Circle “values”, leaving many unsure of their situation.

The ‘Friends & Family test’, favoured by David Cameron, has been repeatedly criticised by commentators including Roy Lilley, academics, coalition ministerial advisors, and now NHS England, which has effectively exposed its inadequacies in a major new report. Perhaps because of some of its deficiencies, it is one of a carefully selected, and limited series of benchmarks which Circle’s management have chosen for Hinchingbrooke to be measured against, rather than measures which do allow some comparison with other trusts, like the annual staff satisfaction survey.

We’re told by Circle that one sign of success is the rising caseload at Hinchingbrooke: but the same people don’t tell us about the problems that NHS trusts face from increased A&E caseload, which is deliberately under-funded at just 30% of the normal tariff, or the disputes between Hinchingbrooke and local commissioners over increasing elective work – or the looming NHS cash crunch, which limits any real growth in hospital caseload. An attempt to lure additional referrals to Hinchingbrooke by offering to pay GPs a £50 per patient “administrative fee” for switching their patients away from other NHS hospitals had to be almost immediately withdrawn amid a storm of hostile publicity.

The company’s most recent half year report, to June 30, published on August 28, complains of unexpected “contractual deductions” by the Cambridgeshire and Peterborough CCG, and describes the local commissioning situation as “highly challenging for 2014-15”. In fact the level of financial subsidy pumped into Hinchingbrooke’s balance sheets by Circle in “support payments” has risen again in 2014 to reach £4.85 million – just £150,000 short of the £5 million maximum after which Circle could either escape from the contract for a further £3.2 million payment, or demand a renegotiation to agree the basis for a continuation of the franchise.

The latest company report also grumbles about the coalition government’s “desire to avoid significant attention on the NHS” in the run up to the 2015 election, which could “create some delay in the procurement of NHS services throughout the country,” dashing Circle’s hopes of securing more contracts in the short term.

Even before this change of stance from the government it was clear that far from being a blueprint of how to run other NHS Trusts, the Hinchingbrooke model is a one-off experiment which few seem willing to emulate. Hoped-for franchises for Circle to run George Eliot Hospital in Nuneaton and Weston Super Mare’s general hospital have not been forthcoming. And there is little sign the company will succeed in its ambitious bid to take over the much larger PFI-encumbered Peterborough foundation trust – where costly teams of management consultants have been searching fruitlessly for solutions to a £40m+ annual deficit for the past year or more.

What kind of “partnership”?

We are repeatedly told by the BBC and other uncritical reporters that Circle is a “partnership,” a John Lewis-style organisation in which staff are empowered and therefore work more effectively: we are even told it might be a model for transforming NHS trusts into “mutuals” or social enterprises. But the evidence for any of this is vanishingly thin. The very notion of “partnership” was only ever partially true, and now, with the “acquisition” of the Virgin Islands-registered Circle Partnership by the hedge-fund and city-owned Jersey-based Circle Holdings, it’s not true at all any more. An undefined number of Hinchingbrooke employees will now apparently be issued with an undefined number of shares in Circle Holdings, on an unclear and apparently arbitrary basis – possibly as part of an individual appraisal process. They had no say over this change of regime. They were not in charge before – and they are even less in charge now.

In fact Circle’s managers at Hinchingbrooke refuse even to meet with the accredited organisations representing staff in the hospital – the unions and the Royal College of Nursing. Time after time longawaited scheduled meetings are simply cancelled, preventing any serious dialogue with the staff at the sharp end of delivering services. One reason for this reluctance at a time of mounting concern over nurse staffing levels might be the findings of a May 2014 survey by the Royal College of Nursing, which found one ward in Hinchingbrooke in which just one nurse was expected to care for 21 patients . This undermines claims that it is the top hospital in the country for quality of care.

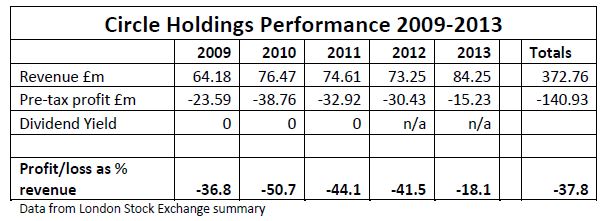

We’re told that the firm has made a financial ‘success’ of Hinchingbrooke, and that Circle itself it is a successful company: but Circle has not yet made a penny profit from its Hinchingbrooke contract, which has soaked up further investment from Circle and NHS cash handouts, and remained in deficit.

It is one of 19 seriously indebted trusts that in July 2014 have been referred by the Audit Commission to Jeremy Hunt for closer scrutiny. Meanwhile the company as a whole has lurched along since 2009 without once delivering a profit. Its earnings before interest, tax, depreciation and amortisation actually fell in the first half of this year, and its loss was greater than in the same period last year, despite increased caseload and revenue. This is not a business model many would care to follow.

Even Circle’s extravagant, bijou private hospitals in Bath and Reading, each with fewer than 30 beds, are entirely dependent on generous contracts from the NHS to keep them afloat. A massive 93% of the private company’s caseload comes from the NHS. NHS volumes for the first half of 2014 were up by 52% at Circle’s Bath hospital, and a colossal 235% in Reading, where NHS patients now account for 45% of total revenue. The Bath hospital has been sold to a US-based company and leased back to reduce costs and clear long-standing debts.

So what is depicted in sycophantic media coverage as a successful private business turns out to be a struggling company that would have collapsed under its burgeoning debt burden without the patronage of government and the NHS on the one hand, and repeated injections of cash from well-heeled speculators on the other. They have now even been reduced to selling off their Bath hospital to ease their cash flow.

So far these investors (like the employee “partners” whose shares paid no dividends) have had no return at all on their investment. How much longer will these powerful and profit-hungry investors, not noted for their patience and willingness to dig in for the long haul, wait for Circle to turn the corner? And what would happen at Hinchingbrooke if they decide to pull the plug?

This report looks at each of these issues, behind the smoke and mirrors, to set the record straight on Circle and the specific challenge it represents to the NHS.

Hinchingbrooke – before Circle

Hinchingbrooke Hospital, run by Hinchingbrooke Health Care Trust (HHCT), was built in 1983. It is a relatively modern, efficient and popular hospital, more than 20 miles from the nearest alternative hospital services. Its size has been constrained by its limited catchment population of just 165,000. It had 310 acute beds in 2007 (now reduced to 223), plus 25 paediatric beds and 12 SCBU cots on site that have now been expanded into a Children’s Unit run by Cambridgeshire Community Services Trust, as well as two mental health wards, run by Cambridgeshire & Peterborough Mental Health Partnership Trust. In addition private treatment is delivered in the Mulberry Unit, which it is claimed generates income for the Trust although no breakdown of income and expenditure appears to have been published. HHCT employed just over 2,000 staff in 2007, with a budget of £62 million.

When the PCT consultation document ‘Seeking Sustainable Health Services for the people of Huntingdonshire’ was drafted, the Trust’s projected deficit was very nearly half its annual turnover – £29.9 million for 2006-7. But this was the first of many subsequent illusions. The deficit had been artificially created by the actions of the SHA, and deepened by the actions of the PCT.

The seeds of this and the subsequent financial malaise go back to the mid 2000s when Hinchingbrooke Health Care Trust, which should in theory have been a winner, instead lost out massively under the government’s controversial “Payment by Results” (PbR) system – as a result of SHA intervention.

As its HHCT’s then Chief Executive Mark Millar pointed out in the 2006-7 Annual Report, the Trust could have been delivering a healthy surplus from 2005 if treatment delivered had been paid for at the PbR tariff, which was significantly higher than the Trust’s historically low costs. However: “the Trust will never see the benefit of payment at tariff … as it is unaffordable for the Primary Care Trust, and the number of people using the hospital is more than national figures”

Cambridgeshire PCT calculated that because Hinchingbrooke had previously provided services at below average cost, if the new PbR national tariff were to be applied and contracts remained unchanged, the total extra cost to the PCT (and benefit to Hinchingbrooke) would have been £13m a year. Across the NHS as a whole, of course, with many trusts running with costs above the new tariff, this would tend to equal out: but Cambridgeshire PCT still faced this local problem. In theory the transition to the new tariff was supposed to be facilitated by a system of Transitional Charges. But instead the SHA stepped in, and imposed excessive penalty payments by the Trust to the Department of Health, totalling a staggering £25.6 million over two years. So HHCT was obliged to pay out the equivalent of two full years of the expected extra income, while receiving next to nothing in return.

Meanwhile the Trust also saw its actual contracts with the PCT whittled away, as the PCT attempted to reduce their referrals to the Trust to match the previous budget, at the new rate. So HHCT lost out both ways round: a cash penalty, up front, PLUS a loss of referrals and long-term income. This was a heavy price to bear for being a low cost provider.

The transitional funding adjustments for HHCT were further compounded by an absurd blunder by HHCT finance bosses, who gave misleading information that resulted in the Trust being massively over-charged. Ironically a PWC report on the crisis pointed out that the transitional charge was intended as a measure to smooth the introduction of PbR and “limit any financial instability”: in fact the result in HHCT was to undermine the long term viability of the Trust itself, and saddle it with huge and unpayable debts. This situation was convenient for a Strategic Health Authority that was already leading the charge towards privatisation of clinical services: it opened the way for discussion of different management options and eventually the experimental franchise with Circle.

The Trust was obliged to borrow £27.3 million in Public Dividend Capital in 2006-7, and according to the PWC report, HHCT’s Board did not at first believe they would have to pay this back.

Disinvestment

To make matters worse, the policy decision was made, initially by Huntingdonshire PCT (which later merged into Cambridgeshire PCT), to scale down the use of hospital treatment. As a result there were prolonged battles over payment for work done by HHCT, and month after month in which Trust patient income fell short of plan. In 2007 UNISON warned of the scale of the PCT’s planned disinvestment:

“The East of England SHA has urged PCTs in deficit to seek ways to reduce hospital activity levels to the “national norm” – disregarding patient choice and local circumstances. Cambridgeshire PCT’s plan involves diverting almost 42,000 patients (25%) away from treatment at Hinchingbrooke – 4,900 elective in-patients, 3,500 non-elective in-patients and over 35,000 outpatients. The essence of the PCT proposal is not “reinvestment” in alternative services in the community and primary care, but disinvestment from hospital care, and cost cutting to balance the PCT’s books – at the expense of HHCT. The plan would cut hospital services by over £10m – but invest just a quarter of that in alternative provision. UNISON is most concerned that no business plan or cost benefit analysis has been published to demonstrate that alternative services on a scale sufficient to meet local needs can be put in place within the limited budget available.”

(Caught in the Crossfire, UNISON Eastern Region 2007)

As if all this was not bad enough, the PCT also planned to squander £2.3 million that should have been in the HHCT budget on purchasing elective care from private sector providers – the nearest of which is 20 miles from Huntingdon.

HHCT directors put forward repeated Recovery Plans. These successfully generated nice income streams for the various management consultants who were brought in to help draw them up, but unsuccessful in their intended purpose. None them addressed the full scale of the problem, or enabled the Trust to meet the duty to break even.

Hinchingbrooke bosses attempted to work the Trust’s way out of financial problems, and were encouraged by decisions and promises of PCTs and the SHA to support and commission work from a new NHS-run Treatment Centre that was planned at the hospital, and on that basis decided to go ahead with the £22m scheme. However their financial plight meant they were obliged to seek funding for even such a modest investment through the Private Finance Initiative, which has since incurred inflated costs in the form of the Unitary Charge to the PFI consortium – and remains a liability for years to come.

NHS cash squeeze

The NHS cash crisis triggered by the banking crash, which ended the annual increases in spending from 2000-2010, has continued to worsen. The Trust faces years more of reducing tariff payments – with commissioners paying the hospital less each year for the same treatment – and a continued squeeze from commissioners seeking to cut the numbers of patients referred for hospital treatment. Because of this continued decline in income and overhang of debt, the business case on which the management of the hospital was eventually contracted out to Circle Health in 2012 centred on achieving an enormous total of £311m in “savings” over ten years – from Hinchingbrooke’s £107m budget.

The National Audit Office – in a review of the process of contracting out to Circle – described this target as “unprecedented” as a share of income. It could only be achieved by substantial cuts. The NAO report on The Franchising of Hinchingbrooke Health Care Trust was published in November 2012, as the financial performance and patient satisfaction ratings of the hospital took a sharp turn for the worse. Less than a month later Circle’s founder, front man and chief executive Ali Parsa stepped down unexpectedly as Chief Executive. The NAO report was critical, but did not get fully to grips with the many failings of the SHA in the Hinchingbrooke affair – most notably the SHA decisions which financially destabilised Hinchingbrooke Healthcare Trust, and the skewed consultation that was conducted on its future, which was always clearly driving towards a private sector “solution”. Nor does the NAO report give any real emphasis to the malign role played throughout by Cambridgeshire Primary Care Trust, and now the Cambridgeshire and Peterborough CCG which has succeeded it: these bodies have consistently worked to undermine the Trust and divert resources from it.

Ideological approach

The NAO report echoed and reinforced UNISON’s concerns over the evidence-free approach of NHS East of England which was the driving force behind the deal. The NAO noted that the Circle contract was based on:

“assumptions that were not directly informed by previous experience” (page 7)

It points out that the very notion of long-term franchising out of management, as embodied in the Circle contract, was (and is) still experimental:

“This approach is untested in the NHS and it is too early to establish and understand the outcome.” (page 40)

The NAO also criticised the lack of rigour in the scrutiny of the final contract by NHS East of England. But it did not explicitly address the fact that that from the beginning the franchising deal was always very much the creature of the Strategic Health Authority. The Trust itself was reduced to a captive

bystander as others took decisions on its behalf.

UNISON has further argued that in place of evidence, SHA policies were driven by ideology, and a commitment to competition and developing a market in health care in place of NHS planning – to the extent that its Director of Policy and Strategy, Dr Stephen Dunn, was fêted by the private sector and awarded prizes for his efforts at Hinchingbrooke and elsewhere by Healthinvestor magazine in 2011, months before the franchise contract was even finalised or Circle’s role commenced.

Desperately seeking savings

There was no miracle. Under Circle’s management, the deficit at Hinchingbrooke rose sharply to £4.1m six months in to the contract, £2m above the expected level, and less than £1m below the £5m limit set out in the contract, above which either Circle or the Trust (with approval) would have the right to walk away from the deal.

Circle and its predominantly private equity investors, who have bankrolled the company through years of losses up to now, get paid nothing until the hospital itself is in surplus.

As the NAO report made clear, Circle’s contract at Hinchingbrooke was based from the beginning on the assumption of achieving massive year-on-year cost savings, at a much higher level than achieved in Trusts anywhere in the NHS:

“Circle’s projected savings of £311 million over ten years are unprecedented as a percentage of annual turnover in the NHS. If delivered, Circle’s proposal will make savings of over 5 per cent recurrently each year over the ten-year life of the contract. An essential element of the projected savings is an assumed annual 4.3 per cent efficiency saving from year four onwards. However, Circle’s bid did not fully specify how it would achieve these savings. […] No fee is payable if a surplus isn’t achieved.” (NAO page 8)

The NAO quotes research by McKinsey for the Department of Health, looking at efficiencies achieved in public and private hospital sectors in different countries: they found that year-on-year savings of much more than 5 per cent had not been achieved anywhere. By the time of the NAO report, Circle was expecting to miss its £9.9m savings target by almost a quarter, generating no more than £7.5m savings in 2012-13, and without new plans to cover this shortfall.

During the summer of 2012 the company itself was propped up by raising another £47m from its astonishingly patient but as yet unrewarded investors: but the greater the capital invested, the stronger the pressure on Circle to begin to deliver the first profits. There could be no profits from Hinchingbrooke until it was running a surplus.

It soon became clear that costs at Hinchingbrooke could only be cut on the scale Circle had promised by cutting jobs. By August the Royal College of Nursing began complaining over planned cuts in nursing posts, and the lack of any proper consultation with staff – a complaint UNISON and other unions had made from the very first involvement of Circle at Hinchingbrooke. 46 nursing and health care assistant jobs were to be cut, some of them through reducing hand-over times between shifts, raising concerns over the quality and continuity of care. None of the staff organisations at Hinchingbrooke endorsed Ali Parsa’s claim in his testimony to the Public Accounts Committee that these job cuts had not been imposed by Circle, but had been somehow decided by the nurses themselves on purely “clinical” grounds:

“We turned our hospital into clinical units and we asked every clinical unit to decide,irrespective of the finances.”

A Health Service Journal report in November included extracts from an unredacted copy of Circle’s (subsequently edited) business plan, published in October. There, the company proposed a 20% cut in workforce as the centrepiece of its ‘savings’. The HSJ article by James Illman revealed that:

“the private franchise operator had anticipated cutting its then 1,600 workforce by around 320 whole time equivalents, although this information was redacted in the publicly available paper.” (HSJ November 8:13)

The HSJ article states that 60% of the job cuts were to be in non-clinical services, leaving around 130 clinical wte posts to be cut over three years. 77 jobs had already been cut without redundancies after the Circle takeover.

The following month Circle renegotiated the hospital cleaning contract with Mitie to reduce cleaning in office areas and at night, cutting 24 cleaning jobs. The local TUC pointed out that reduced cleaning in one area of the hospital would prejudice hygiene standards in other areas too, but Circle pressed ahead with the reduction.

This type of job loss got neatly around limits to Circle’s freedom of action at Hinchingbrooke, which prevent them making more than 20 staff redundant in any 12 month period: this still allows them to get staff to go voluntarily, terminate short term contracts, or reduce numbers of temporary staff – and of course allows them to get sub-contractors to make redundancies which they could not do themselves.

Obviously there is a financial incentive for Circle to push for the savings:

“If Circle makes the savings projected in its bid, it will receive an income of around £31 million over ten years” (NAO page 29)

There is also a brutal bottom line if the company fails to deliver: it will get paid nothing, and could lose up to £7m before escaping if the contract goes seriously wrong:

“Circle only receives payment when the Trust generates an in-year surplus. If the Trust does not generate a surplus in a given year, Circle must cover up to £5 million of the shortfall from its own resources. If the £5 million threshold is breached, either Circle or the Trust board, with the Authority’s approval, have the option to terminate the franchise.” (NAO page 29)

After the replacement of Parsa, who was so publicly identified with the Hinchingbrooke contract, as Circle’s front-man and chief executive, some believed the company could even have been contemplating taking the first opportunity to walk away from the contract to stem the losses – if necessary paying the additional £2m penalty to break free of its commitments.

If this happens, then the issues of accountability and management of the Trust, for which there are no clear contingency plans in place, would come to centre stage, amid the chaotic restructuring from April onwards.

Performance

Because Hinchingbrooke’s scaled-down Trust Board does not meet very often, the information on HHCT’s performance under Circle’s control is limited. But it’s clear from even the minimal amount of detail in the published Board papers that all is not going too well.

The Finance Paper from Month 12 2013/14 shows that an extra cash injection of £800,000 was required from Circle to deliver the Trust’s financial duty to break even: the hoped-for surplus remains elusive. It reports that the QIPP efficiency savings required by the local CCG are not being delivered, while the Trust was experiencing increased levels of demand for its services, raising questions of whether they would be paid for the extra work. This is a particular problem for above target performance in A&E. The current financial regime in the NHS effectively penalises trusts for coping with demand – by CCGs paying them just 30% of the tariff price for additional emergency patients above the 2009 level. Yet of course the responsibility for keeping excess demand out of A&E is down not to the trusts, which have to cope regardless, but the CCGs.

Hinchingbrooke, as one of the country’s smallest A&E departments, with one of the smallest natural catchment areas, has been able to cope comparatively well with A&E caseload, and hit targets for treating patients within 4 hours of arrival in A&E. But this is no guarantee of financial security for the Trust: treating the extra cases may even increase financial pressures.

Recruitment of nursing staff was “proving difficult”, resulting in “interim staffing” (temporary staff) being used to service the increased demand, raising costs. One of the most severe problems according to the most recent Board papers (May 2014) has been in staffing Critical Care beds, with shortages of registered nurses and even more shortages of Health Care Assistants: less than half the required number of HCA shifts were covered. The staffing budget of £65m last year included £7.8m (12%) on “interim staffing” – locums, bank staff and agency staff: “the most expensive staffing resource”. Hinchingbrooke’s proportionate spend on agency staff is almost double the average for Foundation Trusts.

However it appears that the Trust has so far managed to ease its financial problems through increasing income from patient care by £5.4 million while increasing its spend on staff by just £700,000 on the previous year – suggesting a significant increase in workload and pressure on staff. This corresponds with poor performance on key workforce measures: according to the Trust’s own 2014 Workforce Strategy, just 27% of staff felt that there were enough staff for them to do their job properly. Despite all the claims for Circle’s innovative style of management, just 52% of staff would recommend Hinchingbrooke as a place to work, and only 45% felt satisfied with the recognition of their good work – both well below the level of the best NHS trusts. This might help explain the very high staff turnover rate, which – at 12.6% – is almost 50% higher than the NHS average and much higher than the East of England average.

The same Workforce Strategy also points out that Hinchingbrooke now has “complex, remote and expensive admin support functions”, and – perhaps ominously for those already in post – aims instead to have “fewer more multi-skilled colleagues” in these jobs.

What may be more surprising for those who take the hype of Circle’s press releases seriously is that the Trust’s Human Resources department has noted a “limited performance and management culture” and “little innovation in role design”. Engagement with staff is admitted to be another area of failure, despite Circle’s rhetoric of “partnership”:

“Despite introducing lots of new communication channels, colleagues still do not always feel they understand what is happening”

And to make matters even more embarrassing, Circle is better at getting its core messages out to a friendly and docile media than it is at communicating to Hinchingbrooke staff:

“There is confusion between the NHS’ values and Circle’s behaviours, which are poorly understood.”

However the key factor for Circle is the bottom line: the need to cut costs, in order to put the Trust into surplus and open up the possibility of some earnings for the company. So the main attention on staffing levels is on ways of reducing the agency/locum spend, and working towards a “better balance of registered to unregistered nurses” (by which Circle means reducing the proportion of – more expensive – registered nurses in the workforce).

The PALS report and the complaints listed in the Performance Report to the March 2014 Trust Board also show that there is little if any difference between the problems faced and issues raised in delivering care in Hinchingbrooke and those experienced in most NHS and Foundation Trusts.

Staff get no satisfaction

The most recent NHS Staff Satisfaction Survey (data collected in autumn 2013, and published in 2014) gives more details on the extent to which Circle’s much-vaunted “partnership” approach has proved to be an empty boast. Out of 28 Key Findings, Hinchingbrooke comes out worse than the NHS average on two thirds (19), and is in the lowest 20% of trusts in almost half (13). Among the poorest performances, Hinchingbrooke came out in the bottom 20% for staff feeling that their role makes a difference to patients, for [lack of] effective team working, and the percentage of staff working extra hours – a result that is worse than last year. On personal development, additional training and management support to fulfil their potential, Hinchingbrooke was in the bottom 20% on all four key findings. The trust is also in the bottom 20% for staff receiving equality and diversity training, while (perhaps predictably in this context) above average for staff facing discrimination at work.

It was also among the worst trusts for the percentage of staff witnessing potentially harmful errors, near misses or incidents – but also in the worst 20% for staff concerns over the fairness and effectiveness of incident reporting procedures. Hinchingbrooke staff are among the 20% of NHS trust staff most likely to have experienced bullying or abuse from staff [fellow “partners”!]. 29% reported that they had experienced bullying and harassment from staff. They are also among the 20% most likely to feel under pressure to come into work when they feel unwell, with a third of Hinchingbrooke staff saying this had been a problem for them.

The management regime in Hinchingbrooke under Circle has (perhaps half-jokingly) been compared by some staff to North Korea, where the PR spin is undoubtedly less sophisticated. This might be an unfair exaggeration, but the findings from the staff survey show that for hospital staff, it’s a very long way from being the jolly, cosy, egalitarian “partnership” it appears to be in the Circle PR handouts. There is little if any evidence of staff feeling empowered. Tellingly, all of the staff satisfaction issues on which the Trust is in the bottom 20% have shown either no change or a deterioration since the previous survey: whatever Circle has been doing has not been successful. It’s hard to square this with the smugness of the Trust’s response to the Survey findings:

“Our doctors, nurses and staff are our best asset – ensuring they feel engaged and able to deliver the best quality patient care is our top priority. We’ve made some big changes in the last year to make our leadership more visible, to support staff and to empower them to improve services, and results are beginning to show.”

The “partnership”

After several delays and in the midst of a cloud of uncertainty, the company which owns the majority of Circle Health was successfully floated on the stock market in mid-June 2011. The flotation raised £45.3m in additional capital to help pay for its embryonic network of high-cost boutique-style private hospitals, and cover its continuing losses. The company, then valued at £95.4m, was the brainchild of a former Goldman Sachs senior executive Ali Parsadoust (known as Ali Parsa). As part of the process of being admitted to London’s Alternative Investments Market, it published early in June 2011 an “Admission Document” setting out more details of the complex structure of the company, 49.9% of which was owned by a “social enterprise”, Circle Partnership Ltd.

This was always a very unusual social enterprise, registered in the tax haven of the British Virgin Islands. It was the part of Circle proudly boasted to be a “John Lewis style” company, “owned” by Circle’s clinicians, employees and other “partners”. However unlike John Lewis which acknowledges the role of its staff as stakeholders by giving them real and regular cash bonuses as a share of the company’s profits, most of the benefits of Circle’s Partnership were largely or wholly illusory. While never offering its “partners” any real power, the Circle Partnership nonetheless played an important role in the business plan of the Circle group, since it incorporated all of the health care and medical expertise in the company. The consultants were also a key factor in the revenue stream for the company:

“Circle’s independent business strategy depends on the successful operation and expansion of the Circle Partnership. In particular, Circle’s independent business strategy depends on Circle Consultants agreeing (as they have done in CircleBath) to transfer specified percentages of their existing practices to Circle’s new hospitals by way of an agreement (each a “Consultant Agreement”) in exchange for a role and influence in the design and management of the new hospital and an allocation of an ownership interest in Circle Partnership. Each Circle Consultant has agreed to transfer a specified percentage of his or her private practice to Circle only after their local Circle hospital opens (and thereafter for a minimum of 24 months), and Circle is dependent on the Circle Consultants carrying out such obligations for Circle hospitals to become profitable.” (Admission Document, p10)

This made the company dependent upon attracting and retaining consultants – and other staff trained and employed by the NHS – to join the partnership and help to build the business: obviously this carries a substantial risk to existing NHS providers, which may find themselves losing vital staff. However the company also admitted that there was a risk that it might not be able to secure sufficient staff with the right qualifications to expand its business:

“The decisions to build and open new Circle hospitals in new regions depend on whether Circle can secure a sufficient number of consultants in such regions in order to support the economic viability of the new hospitals. In addition, if Circle experiences delays in its roll out of new independent hospitals Circle Consultants may terminate their contracted commitments. As a result, Circle’s ability to generate revenue, become profitable and expand its business will depend substantially on its continuing ability to attract and retain qualified consultants in the Circle Partnership and its local clinician groups. There is competition for such qualified consultants, and there is no assurance that Circle will be able to attract and retain qualified medical professionals. (…). In addition, the number of consultants that may want to become Circle Consultants may be lower than Circle’s strategy requires. Furthermore, Circle may be unable to recruit a sufficient number of suitable local support staff, including nursing and other medical staff …” (page 23).

Within the Partnership, consultants and GP members between them held just over 50% of the 36 million issued shares: “Head Office staff” held another 35%. Another 27 million shares had been authorised but had not yet been issued in 2011 (page 50). However the Admission Document also admitted that although these partners in theory collectively owned just 0.2% less of the business than Circle Holdings plc, (49.9:50.1%) the power to take decisions was entirely concentrated in the hands of the for-profit company, which has always been an investment vehicle for a number of high-powered private equity firms and hedge funds. Registered in the tax haven of Jersey, although having its head office in London, Circle Holdings brought together a board of executive and non-executive directors from the world of corporate finance: only its Chief Medical Officer, Dr. Massoud Fouladi, a consultant ophthalmologist, had any health background.

Dr Fouladi was director of Nations Healthcare – the company running two Independent Sector Treatment Centres (ISTCs) and in negotiation for a third, bigger contract in Nottingham when it was taken over in 2007 by Circle, to give the group its most significant income stream. As with other ISTCs set up under New Labour from 2003, Nations made their money selling uncomplicated elective operations to the NHS, initially at above tariff prices, on centrally-negotiated 5-year block contracts which guaranteed the number of operations to be paid for, regardless of how many patients were actually treated.

Those NHS contracts have gradually come to an end, leaving an increasingly thin and uncertain revenue stream for Circle, which lost two ISTC contracts that were worth £27m in 2010: the even more important £34m a year ISTC contract in Nottingham was eventually renewed on new, and less favourable terms in 2013. Without it, the company would have brought in almost no profit at all.

As the Admission Document admits:

“Since its inception in 2004, Circle has incurred losses as it has grown its business and may continue to incur losses in the future as it expands further. For the year ended 31 December 2008 Circle incurred operating losses of £40.07 million, for the year ended 31 December 2009 Circle incurred operating losses of £19.76 million and for the year ended 31 December 2010 Circle incurred operating losses of £34.97 million. If Circle experiences slower than anticipated revenue growth or if its operating expenses exceed budget, its ability to become profitable may be delayed or become unachievable. Even if Circle achieves profitability in the future, given the evolving and competitive nature of the industry in which it operates, it may not be able to sustain or increase profitability.” (page 9)

Circle and its subsidiaries were also carrying debts totalling £82m, including £14.1m from the acquisition of Nations Healthcare (financed at an astonishing 25% interest, and since paid off) and £43.5m for financing the Nottingham ISTC, with additional borrowing for the leasing of IT and medical equipment, and from the acquisition of land for more new hospitals that have not yet been built. The company had been forced into a number of “breaches of financial covenants” although this appeared to have been patched over by the time of the stock exchange float (page 12).

Even Circle’s showpiece hospital in Bath appeared to be dogged by financial problems: HP (Health Properties) Bath, which owned the hospital and leased it to Circle, was a “non-group joint venture” between the Circle group, a non-group property fund and a company still owned by the collapsed Lehman Brothers: it was in breach of covenant, having failed to pay rent, and in negotiations with the senior lender (page 12).

More recently the Bath hospital itself has been sold to the US-owned Medical Properties Trust at the end of August for an as yet undisclosed price. This has enabled Circle to refinance its debt – and will presumably result in Circle renting back the hospital from MPT. Circle has also withdrawn from the private clinics it was running in Stratford-upon-Avon (which has been taken over by a subsidiary of the South Warwickshire NHS Foundation Trust) and Windsor, in order to focus on inpatient services. Over the previous six years to 2011 existing investors had funnelled in a massive £140m: the question was how long it would be before some of the high-flying directors from the world of corporate finance became impatient for returns that match the levels they are used to making from their investments elsewhere.

But another question was what exactly was the value of the “shares” held by Circle’s medical and other staff and the “partnership role” that was apparently assigned to them? It has now been made clear that the shares never had any real value at all.

When is a share NOT a share?

In practice the “shares” in Circle Partnership could not be sold, paid no dividends, and gave the “shareholders” no vote or voice in the decisions being made by Circle Holdings on where or how contracts would be signed and services delivered. The Hinchingbrooke staff survey shows that despite being described as “partners” most staff are far from convinced that they have any real power or control over anything at all.

While the empty pretence of partnership may have satisfied some of Circle’s more gullible staff, it’s not at all clear how long such a pretence could compensate for the poor working practices of the company that have been clearly revealed at Hinchingbrooke, but may well also prevail in Circle’s other sites – Bath, Reading and Nottingham, where no comparable survey has been taken. In the event the whole Partnership charade lasted up to the end of 2013, when the Circle Holdings PLC decided to cut to the chase, and “acquire” the Partnership. The plan was to “buy out” the effectively worthless shares in an obscure process with an undisclosed number of potentially tradeable shares in Circle Holdings, some of which were to be allocated to staff “provided they meet certain performance criteria”. The suspicions that staff are once again being fobbed off with the equivalent of Monopoly money is underlined by the Health Service Journal report (December 23) which suggests “the criteria for free shares, yet to be agreed, will vary by team and will be arranged as part of individual staff members’ appraisals”. Since Circle’s extremely low rate of staff appraisals is another area of concern in its management regime at Hinchingbrooke (with only 30% having had a ‘well structured appraisal’ in the previous 12 months according to the Trust’s own 2014 Workforce Strategy), this evasive formula could be used to keep staff on the hook for months or even years to come in the hopes of securing extra shares.

Although the new shares, unlike the old ones, will in theory be tradeable, staff will not be allowed to sell what shares they do receive for another 18 months. How much they might get for them is anyone’s guess. The share price over the last 12 months has varied between a high of 87p and a low of 20.5p: as this report is completed it is at 60p. Of course the PR hype is very different: we are told in Circle’s gushing self-publicity that Hinchingbrooke Hospital would:

“become a trailblazer, when it becomes the first general hospital in the history of the NHS to have its employees also become shareholders. We will all move away from simply being employees, to becoming shareholders in Europe’s largest healthcare partnership, as we are all given shares. … This isn’t simply about money; it’s about ownership and helping each and every one of us feel like we genuinely have a stake in our organisation.”

Prior to Circle’s takeover, of course, NHS staff at Hinchingbrooke were all part of a public service, and therefore also “owners” of the service, and (as users of health services) had a genuine stake in securing its future. However that has been lost: now – through no fault or decision of their own – they have become exploited, and often bullied, employees of a profit-seeking private company. Unable to cope with this reality, Circle and its PR gurus are desperate to paint a different, imaginary picture.

The most telling factor is that the staff who were being so generously ‘empowered’ by Circle have actually been given no say over the decision to wind up the Circle Partnership, or on what terms their pretend “shares” would be swapped for the possibility of slightly more real shares in a company which very definitely is NOT controlled by staff, but overwhelmingly controlled by big city investors. In fact they have even less pretend power than before: the previous 49.9% share in Circle Holdings held by Circle Partnership is to be converted into just 25% of the company that will be held by a ‘New Trustee’. However by no means all of these shares would be issued to staff: instead 15.4% would be used to satisfy “share options” that had been issued to the most senior staff by the company’s Remuneration Committee, leaving just 9.6% of the shares as ‘Consideration Shares’, to be issued to staff on terms that are not clearly defined. It’s clear that there is no open or explicit formula or entitlement, and regardless of how many shares staff may have had in the Partnership, they can’t be sure how many “free” shares they will be given.

Although in theory the decision had to be agreed by a vote of members of the Partnership, that decision was already stitched up well in advance of anybody being told what was happening. The entire arrangement, under the name of “Project Reset”, was hatched up in advance, and released in its final form in a “Letter from the Chairman of Circle Holdings PLC” (based in St Helier, Jersey) on December 20.

This admits that Circle Holdings had in effect got bored with the complicated system that had seemed like a good idea when it was set up in 2008, but which was now “overly complex and costly to administer”. In the process of developing the company over the last few years a vast theoretical “group debt” – of £257 million – had been created, accruing compound interest at 7% per annum: as a result of this bizarre set-up and massive burden of debt:

“the value of the CP shares beneficially owned by the CP shareholders has not increased in value, and is not expected to for the foreseeable future.”

However the whole £257 million debt which blocked any payout to Partnership shareholders has now been effectively written off by Project Reset. This plan was essentially threefold: to strip away the Partnership to simplify the company structure, consolidate the control by Circle Holdings, and also raise an additional £25 million. This was intended to fund the set-up costs and working capital for another 3-5 “generic service lines and/or hospital franchises” – although a number of the targets identified for franchising have already proved to be unachievable – and expand into “large markets” for private hospital care in Manchester and Birmingham, neither of which has yet made much progress after years of ambition and promises.

How many Hinchingbrooke staff would willingly opt to be part of such ventures – or partnered with some of Circle’s less savoury major shareholders – had they not been effectively press-ganged into it by the East of England Strategic Health Authority is unclear. Given the regime in the hospital, it’s unlikely staff will now feel free to express their views one way or the another. Few staff seem to be queuing up to work for the Trust: it seems the word has got round that “partnership” like this is more of a threat than a promise.

Who holds Circle Holdings?

Despite the much larger amount of money that has already been invested in it without return (other than through salaries to its directors) Circle Holdings PLC is valued at around £112m on the stock exchange as this report is completed. As of January 2014 (but before the New Trustee had been established), the overwhelming majority (86.7%) of the shares were owned by just five major shareholders:

Lansdowne Partners – 29.2%

Invesco Perpetual – 28.7%

Odey Asset Management – 14.8%

Balderton Capital – 9.0%

BlueCrest Capital Management 5.00%

While Invesco is a relatively recent shareholder, the others have been behind the Circle project for some years. Lansdowne Partners is a hedge fund with $16 billion under management, co-founded by Sir Paul Ruddock (now retired), a generous donor to the Conservative Party. It made a £12million killing in days by exploiting the collapse of Barclays shares in 2009, netting a handsome profit for the financiers’ investors. The company hit the headlines early in 2010 when it signed up Tony Blair to deliver four speeches on world politics to the company’s staff for a fee of £200,000. Ruddock and cofinancier David Craigen have between them donated more than £750,000 to the Tories, most of it since David Cameron became leader.

Odey Asset Management is a hedge fund managing $11.6 billion, run by Crispin Odey, a donor to the Tories and to the Christian Party, whose slogan is “Proclaiming Christ’s Lordship”, as well as £18,000 to Libertas EU. The London financier criticised by the Irish government for allegedly intervening in the 2009 Irish referendum, made a fortune by correctly guessing that banks such as Anglo Irish would collapse without state aid. Harrow and Oxford-educated Mr Odey made a fortune from short-selling British banks in 2008, and then awarded himself a bonus of almost £28m after his investments came right for his clients, boosting his £300m personal wealth. He threatened to move his firm out of Britain to avoid the 50% income-tax rate on high earners. His wife Nichola Pease is deputy chairman of JO Hambro and descended from one of the founding families of Barclays – where her brother in-law John Varley is chief executive.

Balderton Capital, formerly Benchmark Europe, which takes its name from a street in Mayfair – is a $2bn (£1.3bn) venture capital firm with partners drawn from Goldman Sachs and Bain Capital – the investment vehicle of failed Republican presidential candidate Mitt Romney. Balderton’s portfolio includes Betfair, the person-to-person betting exchange, and Alphyra, the pan-European electronic payments provider, as well as Wonga.com, the ultra-high interest lenders of “pay day loans” with rates of 3,000% or more for money borrowed online.

BlueCrest Capital Management LLP, based in Guernsey, is Europe’s third largest hedge fund or “alternative asset management company”. It runs $34bn of client assets, managing significant institutional assets across a number of diversified strategies. The two founders of BCM LLP, Michael Platt and William Reeves (now retired), were both Managing Directors and senior proprietary traders at JP Morgan, and left to establish BlueCrest in 2000. BCMLLP is fully owned by its principals. According to its website, “BlueCrest’s objective has been to construct a trading infrastructure of investment bank quality, upon which trading teams can be built and new strategies developed. BlueCrest believes in a specialist model. … This specialist structure encourages broader overall portfolios with significantly less concentrated risk and can allow the portfolio managers to focus on smaller, more esoteric anomalies that are often overlooked.” Michael Platt, Bluecrest’s boss, has given £125,000 to the Conservative Party

Invesco Perpetual which manages a massive £71 billion in funds, mainly from “retail investors” who rely on the company to manage their funds, was fined a hefty £18.6 million in April this year by the Financial Conduct Authority, for multiple breaches of FCA rules. The company was set up by Sir Martyn Arbib, who has donated £466,330 to the Tories.

The question is with such enormous and generally successful companies holding the vast majority of shares in Circle, are they using the company and its continued losses as a way of reducing their tax liability, or are they growing more and more impatient for the long-promised profits to materialise?

Finances – the case of the missing profits

Circle constantly presents an optimistic view on its financial situation, despite the repeated sums of money that have been ploughed in without return over the years. The last year’s results appeared to have turned the corner, and headed towards significantly reduced deficits, but this was partly as a result of a significant (15%) increase in revenue – almost all of it from the NHS. The first half of 2014 saw earnings down and losses up on the same period in 2013.

The continuing and tightening cash squeeze on the NHS which has seen budgets increase only by inflation since 2010, and set to remain flatlining until 2021, suggest that further such increases are unlikely to continue. Meanwhile the private sector income from Circle’s costly hospitals in Bath and Reading has failed to grow as expected, leaving the company even more reliant on public sector funding to keep it afloat.

Private hospitals

Both of Circle’s private hospitals have been losing money, and private revenue growth has “seen a slower upturn than expected” according to the Chairman’s letter of December 2013. Circle’s Bath Hospital, having barely broken free of repeated losses, lost another £2.7m in the first six months of 2013, and has now switched its attention to securing more (profitable) NHS work. Such has been the squeeze on the local NHS that CircleBath now claims to command a 40 percent share of the local “market” for elective orthopaedic operations (hips, knees and ankles).

CircleReading also registered losses on its private patient work of £3.5m over the first six months of 2013, and it too has begun to focus on “driving NHS revenue growth”.

Despite the heavy investment in state of the art buildings and luxurious environment, Circle’s private hospitals are both financial failures that would be in a state of collapse without the welcome injection of millions of NHS spending, further showing that the notion of Circle commanding a genuine and growing market in private healthcare is an illusion fostered by the spin maestros of Circle’s PR department.

NHS contracts

Circle’s income from the NHS is not restricted to Hinchingbrooke and the treatment of NHS patients in its private hospital beds. Indeed even though their hopes of winning franchises to run NHS hospitals in Nuneaton and Weston Super Mare have fallen flat, the company is actively seeking additional NHS contracts across the country, with mixed success.

The former East of England SHA region is once again one of the more promising areas for Circle’s ambitions. A Circle-led consortium (which also handily included a company owned by almost half the GP practices in Bedfordshire, maximising the chances of a favourable decision by the CCG) did manage to win the £160m five year contract to deliver Musculoskeletal (MSK) services in Bedfordshire.

However Circle’s more ambitious link-up with Capita and the Cambridgeshire Community Services Trust and Oxford Health NHS Foundation Trust in a consortium bid for the biggest prize so far, the £800m contract for Older Peoples services in Cambridgeshire and Peterborough was unsuccessful. The consortium, despite making it through to a shortlist of ten, pulled out of the tendering process at a relatively early stage arguing that the proposed terms were “not commercially viable”. Unofficial sources “close to Capita” have said that the contract was under-priced, and that Capita calculated the contract could result in losses of £30-£50 million per year.

Both of these bids indicate once again that Circle does not feel constrained from bidding for work by its lack of local knowledge or appropriate expertise – and that CCGs determined to outsource pathways of care appear unwilling to take either factor into account in their shortlisting of potential contractors, leaving existing NHS bidders at a serious disadvantage.

Circle has spotted this chance to cash in on more NHS contracts. The Chairman’s letter of December 20 points encouragingly to the fact that £5 billion worth of contracts were already being tendered by CCGs, with many more expected to be opened up to “any qualified provider” as a result of the Health & Social Care Act 2012 – giving Circle more hope that profits might be made from the NHS in the near future.

Tax dodging

The Chairman’s letter announcing Project Reset and giving an update on the progress of the company comes from its base in the tax haven of Jersey.

Circle Partnership went one step further, and was based even further from the tax inspector’s reach in the British Virgin Islands. As a result, while none of the company’s British workforce had any real say over Project Reset, the entire deal was subject to the rubber stamp of the British Virgin Islands Court – and the Jersey Financial Services Commission.

What this shows is that if the company ever does generate a profit from its extensive NHS contracts, we can be sure that none of that extra money will flow back to the Treasury in taxation: the company is feeding off the public sector but – no doubt to the delight of its hedge fund sponsors, it is running its affairs to ensure that Circle Holdings does not contribute to public budgets.

Conclusion

Circle’s PR staff may be masters of the art of illusion, but behind the smoke and mirrors we have a company that makes no profits and exists only through the patronage of the NHS and public funds, that presents itself as a partnership but has failed to convince its own staff that this is any more than a phrase, and which – at least in Hinchingbrooke – trades on patient satisfaction surveys of doubtful value, while being among the worst in the country for bullying and exploiting its own staff.

The Circle management principles seem fine enough on paper, but mean little to staff working shorthanded and lacking additional training and support. The company’s management regime may not be on the level of the North Korean despotism, but it is no workers’ paradise.

The rise and prominence of Circle reflects the determination of successive governments to hand over more NHS contracts to private providers at the expense of existing NHS trusts, a policy eagerly applied by the East of England Strategic Health Authority. But the public image of Circle also reflects a weak, uncritical news media that has been willing time and again to simply rehash PR spin and press releases from Circle without making any real attempt to look behind the smoke and mirrors.

The British public deserves better.